Paying money is NOT a bargaining chip.

Whereas paying money for a brand new dwelling might be an enticement to the property proprietor, and presumably assist with value negotiations, the identical doesn’t apply when buying a automotive from a dealership.

This since you having money at home-purchase closing time means a fast transaction, and no time-consuming mortgage-approval complications. And mortgage hiccups can add days, possibly weeks, to the real-estate buy course of.

Ought to I Pay Money for My Automobile?

Bargaining Chip

However, when buying a automotive or truck, the loan-application course of typically takes lower than an hour, and—and that is key—automotive sellers earn fee in your automotive mortgage, offering they organize your financing.

And, right here is the place issues get attention-grabbing: whereas automotive sellers earn a small fee for arranging the mortgage, the shop additionally makes cash by marking-up the mortgage. Which implies, not solely do you, the patron, have to barter the worth of the automotive, you even have to observe the mortgage rate of interest.

Markup

Sellers safe funds for automotive loans at what is named the “purchase charge,” after which cost clients what is named the “promote charge.” The distinction is paid to the vendor by the lender as fee on the deal.

Curiosity Charges

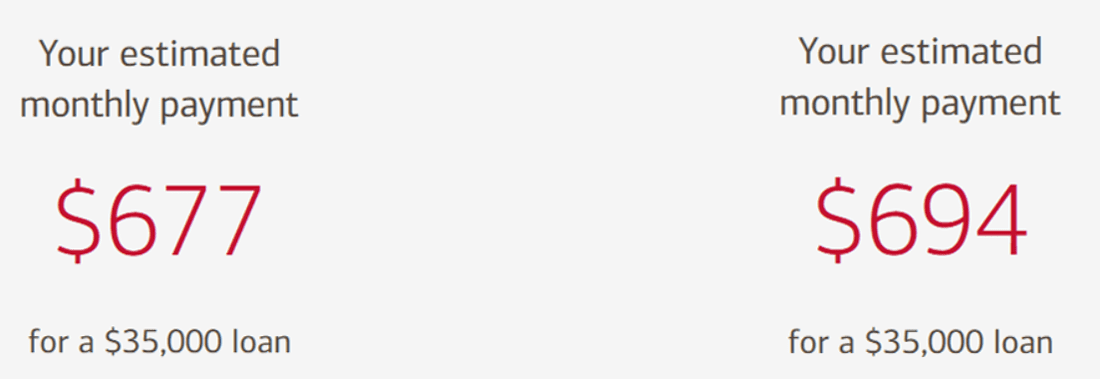

Per one supply, the typical automotive mortgage is marked up by a couple of p.c by the vendor. Immediately, a vendor might lock in a purchase charge of 6.0 p.c, and promote loans at nearer to 7.0 p.c. On at 60-month $35,000 mortgage, that’s the distinction between a $674 month-to-month cost, and a $694 tab. Over the lifetime of the mortgage, that’s precisely $1200. That’s not chump change.

Paying Money

By paying money—or by arranging your mortgage with one other establishment–you might be really reducing into the vendor’s revenue on the sale of your car.

When you do select to finance by the dealership, make sure you know what the prevailing car-loan pursuits charges are. And, if the charges you’re being provided appear too excessive, merely delay the acquisition of your car till you’ll be able to organize a third-party mortgage that’s extra reasonably priced.

If You Can, Pay Money

To reply the unique query: When you will pay money on your automotive, by all means accomplish that. Avoiding the curiosity on a mortgage is the good factor to do—simply don’t anticipate the vendor to be particularly comfortable about it. Sadly, paying money for a brand new or used automotive or crossover is just not a bargaining chip.